Japan: A Heated Products Story

"Heated Products account for 44% of the tobacco product market in Japan and in Tokyo it is up to 50%"

Emma Dean

Area Director, APMEA North & General Manager, British American Tobacco Japan, Ltd

At a glance

Japan is the leading market for Heated Products

>44%

Heated Products hold >44% share of the total tobacco product market[1,2]

-33%

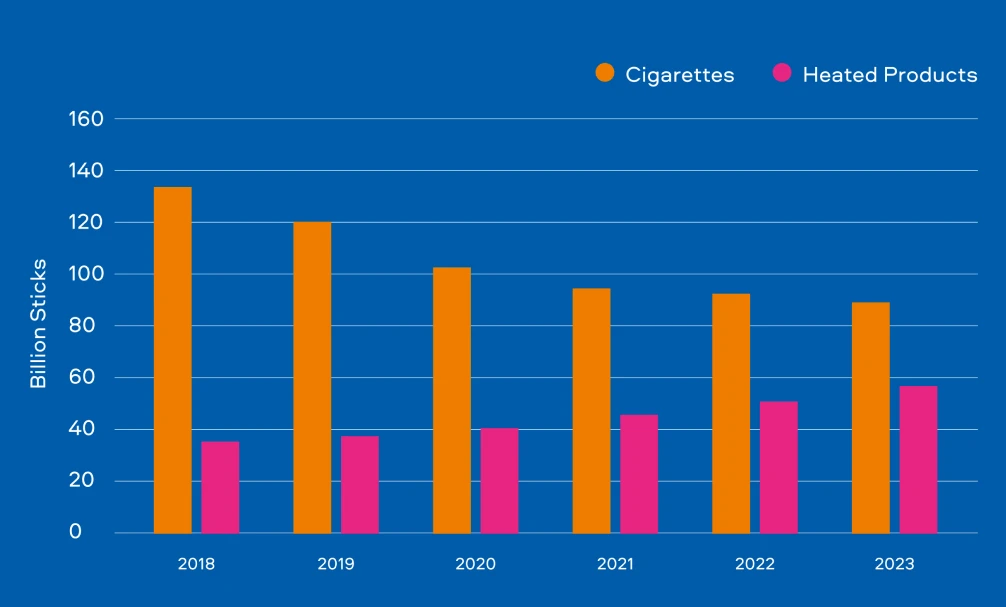

Between 2018 and 2023, domestic cigarette sales dropped approximately 33%, from 133.6 billion sticks to 89.2 billion sticks[1]

>60%

Between 2018 and 2023, Heated Product sales grew by more than 60%, from 35.1 billion sticks to 56.6 billion sticks[2]

Sign up for more exclusive the Omni™ content

0.3%

of junior and senior high-school students reported current use of Heated Products in a 2021 online survey funded by the Ministry of Health, Labour and Welfare, Health Science Research Fund in Japan[4]

Japan is a leading market for Heated Products, also known as heat-not-burn (HNB) products. By heating tobacco rather than burning it, Heated Products produce fewer harmful chemicals compared to traditional cigarettes.

In the mid-1970s, Japan had a cigarette smoking prevalence of ~75% amongst men.[3] Since the three most prominent tobacco product manufacturers in Japan launched Heated Products between 2014 and 2016, domestic cigarette sales have dropped whilst Heated Product sales have grown. Between 2018 and 2023, domestic cigarette sales decreased by approximately 33%, from 133.6 billion sticks to 89.2 billion sticks, whilst Heated Product sales increased by more than 60%, from 35.1 billion sticks to 56.6 billion sticks. Today, the share of the total tobacco product market for Heated Products has grown to more than 44%.

Development and introduction of Heated Products in Japan

2014

PMI launches Japan’s first Heated Product, IQOS in Nagoya

2016

BAT launches its first Heated Product, glo, in Sendai, and Japan Tobacco Inc. launches its Heated Product, PloomTECH, in Fukuoka.

2017

As adult smokers switched to Heated Products, PMI, BAT and JTI began to roll their Heated Products out nationally.

2018

Introduction of separate regulation to that for traditional cigarettes. The Japanese regulations allowed for separate taxation and marketing practices for Heated Products, creating a more favourable retail environment and making them an attractive alternative for adult smokers who would otherwise continue to smoke.

2019

Continued market expansion across Japan sees Heated Products use prevalence rise to 11.3% from 0.2% in 2015

2020

Device evolution and flavour expansions create improved consumer experiences, further driving Heated Products adoption.

2024

Heated Products hold a >44% share of the total tobacco product market.

The growth of Heated Products in Japan can be attributed to several factors

Reduced harm perceptions

Academics from Canada, U.S. and Japan conducted a national International Tobacco Control web-based survey that included more than 500 Heated Product consumers. The results from this survey identified the most common reasons for regularly using Heated Products were "beliefs that HTP [Heated Tobacco Products] are less harmful than cigarettes to themselves (90.6%) or to others (86.7%), enjoyment (76.5%), and social acceptability (74.4%)".[5]

Tobacco consumption culture

Japan has a strong tobacco consumption culture, and Heated Products provided a novel and technologically advanced option for adult smokers looking for a change from conventional cigarettes.

Innovation

Japan is a country that has long been seen as being at the forefront of innovation, for example, this is the nation that invented bullet trains and android robots.[6] The Government of Japan has stated that "Japan leads developed markets in the infrastructural pull factors of research and development capabilities and early technological adoption" and "continues to forge ahead, advancing innovation on a global level".[7] We believe Japan's tradition of early adoption of technology is a contributing factor in the growth of Heated Products.

Social consideration and personal hygiene

Heated Products were perceived as more socially acceptable due to their reduced smell and absence of smoke production compared to conventional cigarettes. Overall, the Heated Product experience offers adult smokers, who would otherwise continue to smoke, an alternative that combines authentic tobacco-flavour with modern technology. However, the long-term health effects of using Heated Products are still being studied, and these products are not risk free and are addictive.

Opportunity for Japan

There remains an opportunity for the Japanese Government to integrate further Tobacco Harm Reduction as good public policy. This might include encouraging smokers who would otherwise not quit to switch to Smokeless Products and also further establish excise for Heated Products relative to their risk profile.

Figure 1. Stick Sales in Japan, 2018-2023

Sources

[1] Euromonitor International, Market Sizes, Cigarettes – Japan, Tobacco: Euromonitor from trade sources/national statistics (Accessed 5 August 2024)

[2] Euromonitor International, Market Sizes, Heated Tobacco – Japan, Tobacco: Euromonitor from trade sources/national statistics (Accessed 5 August 2024)

[6] World Economic Forum, 5 Japanese innovations that changed the world. 2016. (Accessed: 29 July 2024)

[7] Bloomberg, Japan: Where innovation is borderless. (Accessed: 29 July 2024)

Sign up for more exclusive the Omni™ content

-

Smokeless Products: An IntroductionRead more

Smokeless Products: An IntroductionRead more -

01. Our Vision: A Need for ReappraisalRead more

01. Our Vision: A Need for ReappraisalRead more -

02. The Big QuestionsRead more

02. The Big QuestionsRead more -

03. Impact of SmokingRead more

03. Impact of SmokingRead more -

04. Our Smokeless ScienceRead more

04. Our Smokeless ScienceRead more -

05. Our Smokeless ProductsRead more

05. Our Smokeless ProductsRead more -

06. THR: A Global TransformationRead more

06. THR: A Global TransformationRead more -

07. THR: Global RegulationRead more

07. THR: Global RegulationRead more -

08. THR: Scientific EngagementRead more

08. THR: Scientific EngagementRead more -

09. Our Future OutlookRead more

09. Our Future OutlookRead more -

10. ReferencesRead more

10. ReferencesRead more -

11. Our Published THR ScienceRead more

11. Our Published THR ScienceRead more